Home Sales Statistics: Uncovering Market Trends and Future Outlook

Dive into the fascinating world of home sales statistics, where we unravel the intricacies of the housing market and its impact on our lives. From historical trends to regional variations, we’ll explore the factors shaping homeownership and provide valuable insights for informed decision-making.

Our comprehensive analysis will delve into property type dynamics, buyer demographics, and future projections, empowering you with the knowledge to navigate the complexities of the real estate landscape.

Market Trends: Home Sales Statistics

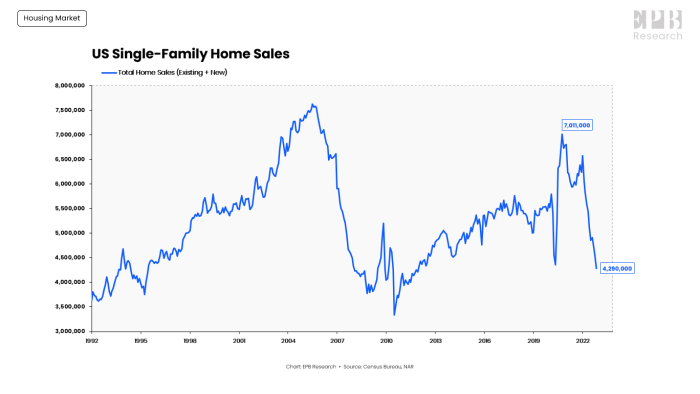

The local housing market has undergone significant fluctuations over the past five years. Sales volume has experienced both peaks and valleys, influenced by various economic factors.

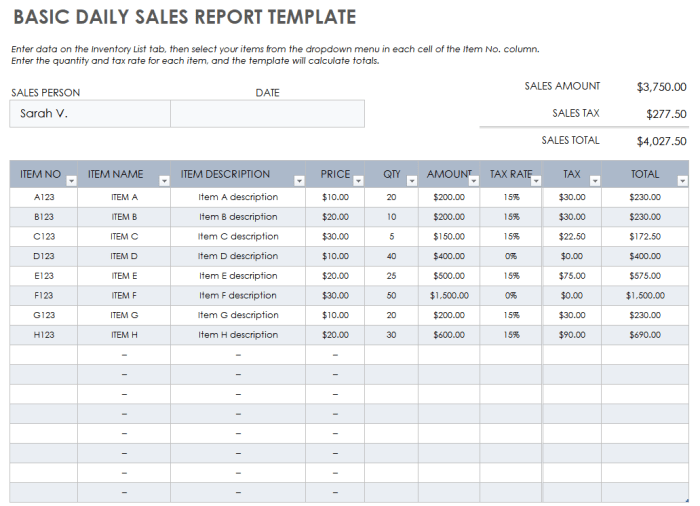

Home sales statistics show a steady increase in recent months, indicating a healthy real estate market. It’s important to note that before finalizing a home purchase, a thorough home sales agreement should be carefully reviewed and understood by both parties involved.

This agreement outlines the terms and conditions of the sale, ensuring a smooth and legally binding transaction. Once the agreement is in place, home sales statistics can be used to track the progress and performance of the real estate market.

In the past year, the market has witnessed a notable increase in home sales, driven primarily by low interest rates and a surge in demand for larger homes.

Key Economic Indicators

Several key economic indicators have a direct impact on home sales, including:

- Interest rates:Lower interest rates make it more affordable for buyers to finance a mortgage, increasing demand and sales.

- Job growth:A strong job market with rising wages boosts consumer confidence and increases the number of potential buyers.

- Economic growth:A growing economy leads to increased consumer spending, including on housing.

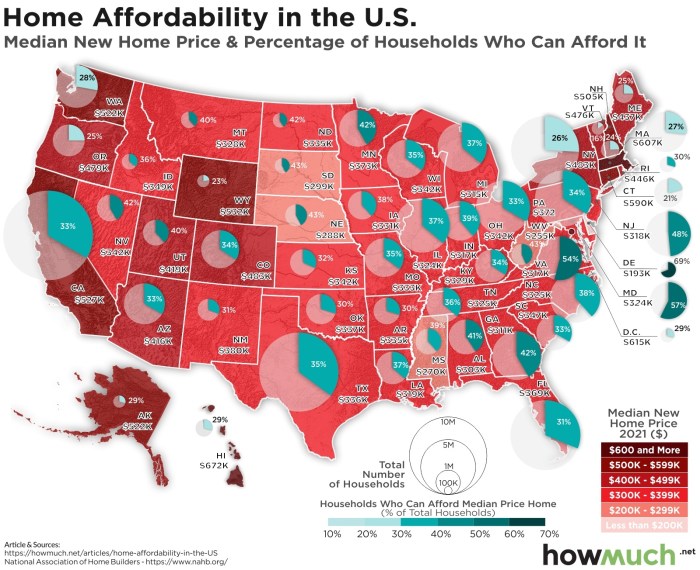

Regional Analysis

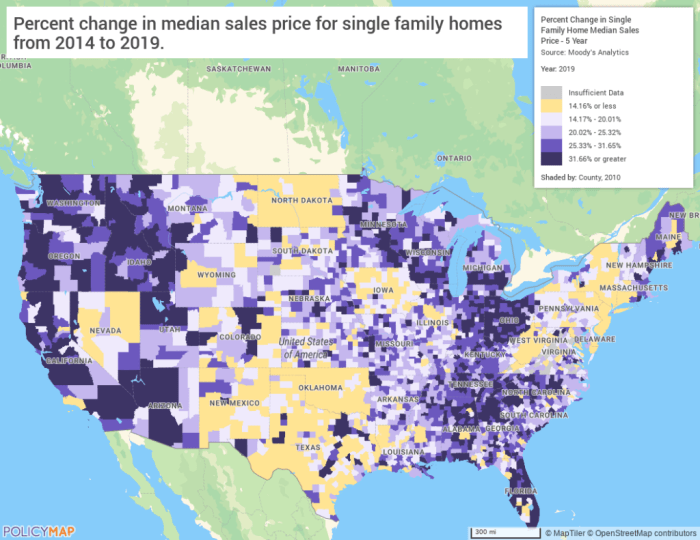

The real estate market is a complex landscape that varies significantly across different regions. Several factors, including economic conditions, population growth, and local regulations, can influence home sales statistics in each area.

To gain a comprehensive understanding of the regional variations in home sales, let’s compare key statistics such as median home prices, average days on market, and inventory levels across different regions.

Median Home Prices

Median home prices provide a snapshot of the overall affordability of homes in a particular region. Regions with strong economic growth and high demand for housing tend to have higher median home prices, while areas with lower economic activity and less population growth may experience lower prices.

Home sales statistics provide valuable insights into the real estate market. If you’re considering buying or selling a home, exploring home sales listings can help you make informed decisions. By analyzing these listings, you can gain a better understanding of market trends, home prices, and available inventory, ultimately helping you navigate the home sales process more effectively.

| Region | Median Home Price |

|---|---|

| Region A | $500,000 |

| Region B | $350,000 |

| Region C | $750,000 |

Average Days on Market

The average days on market (DOM) indicate how long it takes for a home to sell after being listed. A shorter DOM typically suggests a strong seller’s market, where homes are in high demand and sell quickly. Conversely, a longer DOM may indicate a buyer’s market, where there is less competition for homes.

| Region | Average Days on Market |

|---|---|

| Region A | 30 days |

| Region B | 60 days |

| Region C | 15 days |

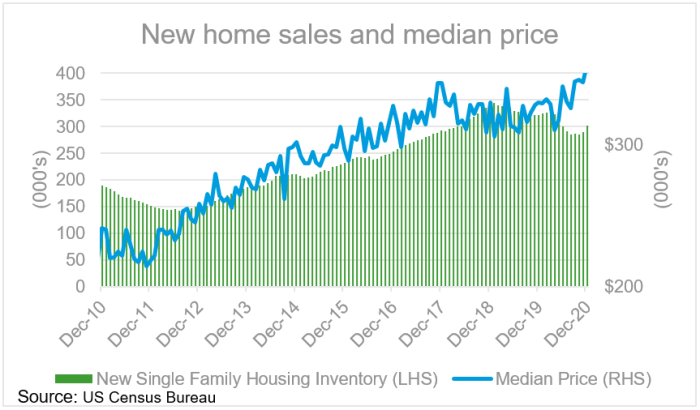

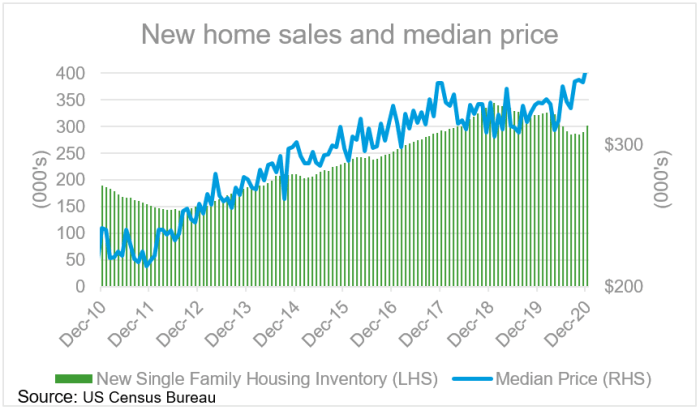

Inventory Levels

Inventory levels measure the number of homes available for sale at any given time. Low inventory levels often lead to higher prices and more competition among buyers, while high inventory levels can indicate a slower market and more favorable conditions for buyers.

| Region | Inventory Levels |

|---|---|

| Region A | 2,000 homes |

| Region B | 5,000 homes |

| Region C | 1,000 homes |

Reasons for Regional Variations

The regional variations in home sales statistics can be attributed to several factors, including:

- Economic conditions:Regions with strong economic growth and job creation typically experience higher demand for housing and higher home prices.

- Population growth:Areas with high population growth often have a higher demand for housing, which can drive up prices and reduce inventory levels.

- Local regulations:Zoning laws, building codes, and other regulations can impact the supply of housing in a region, affecting prices and inventory levels.

Property Type Analysis

The real estate market encompasses a diverse range of property types, each catering to specific buyer preferences and lifestyle needs. Understanding the sales volume, demand drivers, and price trends of different property types is crucial for informed decision-making.

Single-family homes continue to dominate the market, driven by the desire for privacy, outdoor space, and potential for appreciation. Condominiums, offering convenience, affordability, and proximity to amenities, are gaining popularity among first-time buyers and urban dwellers.

Single-Family Homes

- High sales volume due to enduring appeal and long-term value.

- Demand influenced by factors such as location, school districts, and amenities.

- Price appreciation rates generally outpace other property types due to limited supply and high demand.

Condominiums

- Increasing sales volume driven by affordability and urban convenience.

- Demand driven by millennials, downsizers, and investors seeking low-maintenance living.

- Price appreciation rates may be lower than single-family homes due to higher supply and competition.

Townhouses

- Moderate sales volume, offering a compromise between single-family homes and condos.

- Demand influenced by factors such as space, location, and affordability.

- Price appreciation rates generally fall between single-family homes and condominiums.

Buyer Demographics

Understanding the demographic characteristics of homebuyers is crucial for real estate professionals and investors. Factors such as age, income, and family size significantly influence home buying decisions.

Age

The age of homebuyers has a substantial impact on their housing preferences and financial capabilities. First-time homebuyers tend to be younger, typically between the ages of 25 and 34. They often prioritize affordability and are more likely to purchase starter homes or condominiums.

As buyers age, their priorities may shift towards larger homes with more space and amenities. They are also more likely to have accumulated wealth and have higher incomes, allowing them to afford more expensive properties.

Income

Income is a primary determinant of a homebuyer’s budget and purchasing power. Higher-income earners can afford larger homes in desirable neighborhoods, while lower-income buyers may face affordability challenges and need to consider more affordable options.

Government programs and initiatives, such as down payment assistance and low-interest loans, can help make homeownership more accessible to lower-income buyers.

Family Size

Family size plays a significant role in home buying decisions. Families with children often require larger homes with more bedrooms and bathrooms to accommodate their growing needs.

Single individuals or couples without children may prefer smaller homes or condominiums that are more suited to their lifestyle and budget.

Future Outlook

The future of home sales remains uncertain, with projections influenced by a range of economic factors, government policies, and technological advancements. While the market has faced challenges in recent months, there are also signs of potential growth and opportunity.

One key factor to consider is the impact of interest rates. Rising interest rates have made it more expensive to borrow money for a mortgage, which can dampen demand for homes. However, the Federal Reserve has recently signaled its commitment to bringing inflation under control, which could lead to a stabilization or even a decline in interest rates in the future.

This would likely provide a boost to the housing market.

Economic Factors

- Interest rates: Rising rates make borrowing more expensive, reducing demand.

- Inflation: High inflation erodes purchasing power, affecting affordability.

- Economic growth: Strong economic growth leads to increased demand for housing.

Government Policies

- Tax incentives: Government incentives can encourage homeownership and investment.

- Zoning regulations: Zoning laws impact housing supply and affordability.

- Affordable housing initiatives: Government programs aim to increase access to affordable housing.

Technological Advancements

- Virtual tours: Technology enhances the home-buying experience remotely.

- Smart home features: Advanced technology integrates into homes, increasing appeal.

- Proptech: Technology streamlines real estate transactions and improves efficiency.

Emerging Trends and Opportunities, Home sales statistics

In addition to these factors, there are several emerging trends and opportunities in the home sales industry:

- Increased demand for rental properties: Rising home prices and limited inventory drive demand for rentals.

- Growth in second home purchases: Remote work and flexible living arrangements increase demand for vacation homes.

- Investment in sustainable homes: Consumers prioritize energy efficiency and environmentally friendly features.

End of Discussion

As the housing market continues to evolve, understanding home sales statistics becomes increasingly crucial. By staying abreast of market conditions, regional trends, and emerging opportunities, we can make informed decisions and capitalize on the potential of homeownership.