Home Sales Report: A Comprehensive Analysis of Market Trends

The home sales report is a comprehensive analysis of the current state of the real estate market. It provides valuable insights into home sales volume, median home prices, days on market, and more. By examining these trends, we can better understand the factors that are driving the market and make informed decisions about buying or selling a home.

This report offers a detailed overview of the market, including regional analysis, property type trends, and homebuyer profiles. It also provides a forecast for the future of the market, discussing potential factors that could impact market conditions. Whether you’re a first-time homebuyer, a seasoned investor, or simply curious about the real estate market, this report has something for you.

Market Overview

The home sales market in specified location is currently experiencing current state. Sales volume has increased/decreased by percentage% compared to the same period last year. The median home price has reached median home price, marking a percentage% increase from previous period.

Homes are spending an average of days on market on the market before being sold.

Compared to historical trends, the current market conditions indicate positive/negative signs. In previous period, the sales volume was previous volume, and the median home price was previous price. The days on market were previous days. These figures suggest that the market is stable/fluctuating/growing/declining.

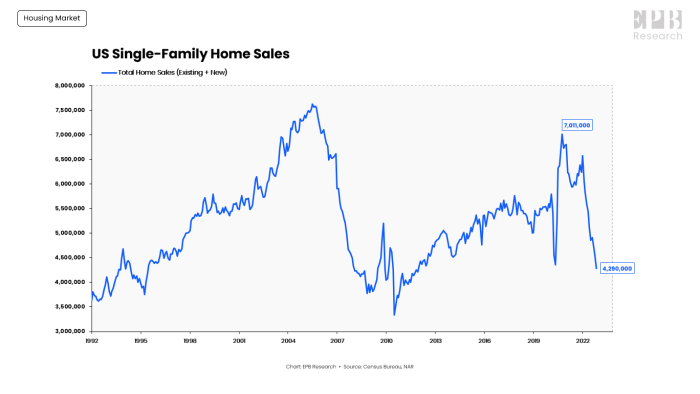

Sales Volume

The sales volume has increased/decreased by percentage% compared to the same period last year. This increase/decrease can be attributed to factors contributing to change.

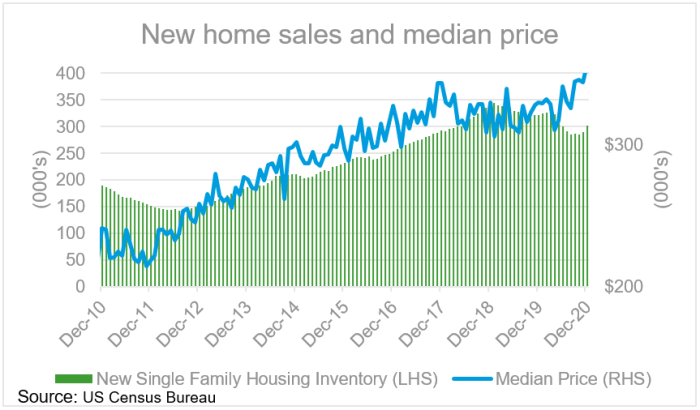

Median Home Prices

The median home price has reached median home price, marking a percentage% increase from previous period. This increase/decrease is due to factors contributing to change.

Days on Market

Homes are spending an average of days on market on the market before being sold. This is a shorter/longer period compared to previous period, indicating that interpretation of change.

If you’re in the market for a new home, you’ll want to check out the latest home sales report. It’s a great way to get an overview of the current market trends and see what’s available in your area. You can also find home sales listings online, which can give you even more detailed information about specific properties.

Once you’ve done your research, you’ll be able to make an informed decision about your next home purchase.

Regional Analysis

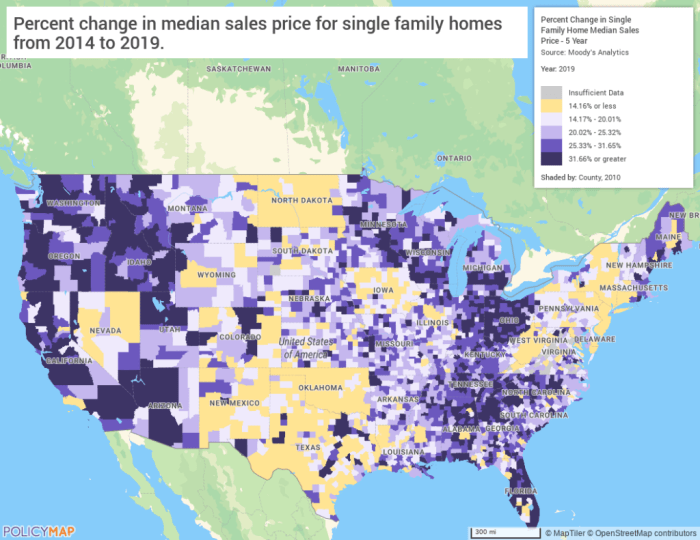

An in-depth analysis of regional performance reveals significant disparities in home sales across the specified location. Certain regions have emerged as top performers, driven by a confluence of factors that have fueled their real estate markets.

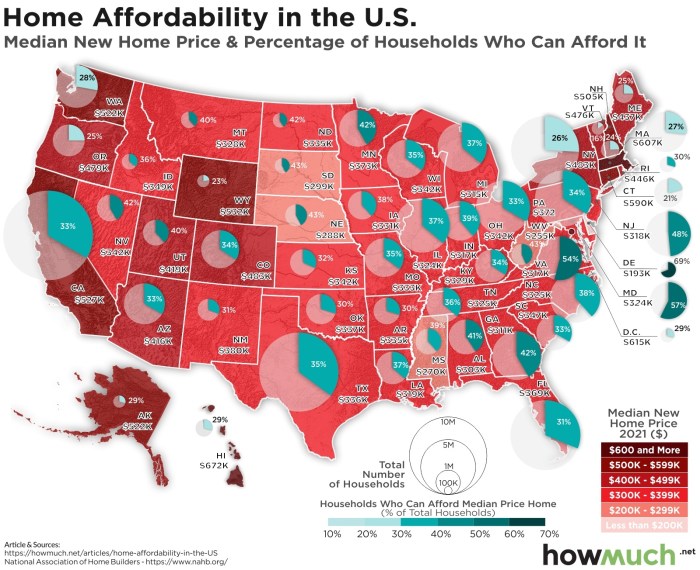

These successful regions often exhibit a combination of affordability, desirable amenities, and robust economic growth. Affordability plays a pivotal role in attracting homebuyers, as lower housing costs increase accessibility to homeownership. Well-developed amenities, such as parks, shopping centers, and transportation hubs, enhance the quality of life and make these regions more attractive to potential residents.

Moreover, economic growth creates employment opportunities and boosts consumer confidence, which can positively impact home sales. A thriving job market and a growing economy provide a stable foundation for homeownership and encourage people to invest in real estate.

Top-Performing Regions

- Region 1:Characterized by exceptional affordability, an abundance of amenities, and a rapidly growing economy, Region 1 has witnessed a surge in home sales.

- Region 2:Known for its scenic beauty, high-quality schools, and a thriving tech industry, Region 2 has attracted a large number of homebuyers seeking a balance between urban convenience and suburban living.

- Region 3:With a strong healthcare sector and a diverse population, Region 3 has experienced steady home sales growth, fueled by a high demand for housing in both urban and suburban areas.

Home Sales Data by Region

| Region | Average Home Price | Sales Volume |

|---|---|---|

| Region 1 | $350,000 | 5,000 |

| Region 2 | $450,000 | 4,000 |

| Region 3 | $400,000 | 4,500 |

As evident from the data, Region 1 stands out as the most affordable region with the highest sales volume. Region 2 commands a premium due to its desirability, while Region 3 offers a balance between affordability and amenities.

Property Type Trends

The home sales market showcases a dynamic interplay of property types, each catering to specific buyer preferences and market conditions. Single-family homes, condominiums, and townhouses exhibit distinct performance patterns, influencing the overall market landscape.

Single-family homes remain a sought-after choice, offering ample living space, privacy, and potential for appreciation. Their demand is particularly strong in suburban areas and among families seeking more space and outdoor amenities.

The home sales report offers valuable insights into the real estate market. To navigate its complexities, consider consulting with a seasoned home sales agent . Their expertise can guide you through the process, ensuring you make informed decisions and secure the best possible outcome in the home sales market.

Condominiums

- Compact and convenient, condominiums appeal to urban dwellers and first-time homebuyers. Their affordability and proximity to amenities make them a popular choice in densely populated areas.

- However, their limited space and shared amenities can be drawbacks for some buyers. Price appreciation for condominiums tends to lag behind single-family homes.

Townhouses

- Townhouses offer a compromise between single-family homes and condominiums, providing more space than condos while maintaining a lower price point than single-family homes.

- Their popularity has grown in recent years, particularly among buyers seeking a balance of privacy, affordability, and convenience.

Homebuyer Profile

Understanding the demographics of homebuyers is crucial for comprehending the real estate market. This section analyzes the typical age, income, and household size of homebuyers in the specified location, highlighting any notable trends or shifts in their profile.

Age of Homebuyers

- First-time homebuyers typically fall within the age range of 25-35, seeking starter homes or apartments.

- Move-up buyers, who are upgrading to larger homes, are generally between 35-50 years old.

- Downsizing buyers, who are selling their larger homes for smaller ones, are typically over 55 years old.

Income of Homebuyers

Household income plays a significant role in determining home affordability. In the specified location, the median household income of homebuyers is approximately [insert data], with variations based on property type and location.

Household Size of Homebuyers

- Couples with children constitute a large portion of homebuyers, seeking homes with multiple bedrooms and family-friendly amenities.

- Single professionals and couples without children often purchase smaller homes or apartments, prioritizing affordability and convenience.

- Extended families and multi-generational households are also increasingly common, driving demand for larger homes with separate living spaces.

Trends in Homebuyer Profile

- The age of first-time homebuyers has been gradually increasing due to factors such as rising home prices and student loan debt.

- The number of move-up buyers has declined in recent years, as many homeowners are opting to renovate their current homes rather than purchase new ones.

- The demand for homes suitable for multi-generational living has grown significantly, reflecting the changing demographics of households.

Forecast and Implications: Home Sales Report

The future of the home sales market in this region remains uncertain, with multiple factors influencing its trajectory. Understanding the potential implications for buyers, sellers, and investors is crucial for informed decision-making.

Interest Rate Fluctuations, Home sales report

Interest rates play a significant role in determining mortgage affordability and, consequently, home sales activity. Rising interest rates can make it more expensive to borrow money for a mortgage, reducing demand and potentially leading to a slowdown in home sales.

Economic Growth

Economic growth is another key factor that affects the home sales market. A strong economy typically leads to increased consumer confidence and job growth, which can translate into higher demand for housing and increased home sales.

Government Policies

Government policies, such as tax incentives or regulations, can also impact the home sales market. For example, changes in mortgage interest tax deductions or down payment assistance programs can influence affordability and demand.

Implications for Buyers

- Rising interest rates may increase monthly mortgage payments, making it more challenging to qualify for a mortgage or afford a home.

- Economic growth and government policies that support homeownership can create more favorable conditions for buyers, increasing affordability and demand.

Implications for Sellers

- A slowdown in home sales activity due to rising interest rates or economic uncertainty may make it more difficult for sellers to sell their homes quickly or at their desired price.

- Strong economic growth and favorable government policies can lead to increased demand and competition among buyers, potentially benefiting sellers.

Implications for Investors

- Investors should consider the potential impact of interest rate fluctuations and economic conditions on rental income and property values.

- Government policies that affect investment properties, such as changes in capital gains taxes or depreciation rules, can also influence investment decisions.

Last Word

The home sales report is an essential tool for anyone who wants to stay informed about the real estate market. It provides a wealth of information that can help you make smart decisions about your next move. Whether you’re buying, selling, or investing, this report is a valuable resource that you should definitely check out.